Decentralized Finance (DeFi) has been the buzzword in the crypto space, promising a financial utopia without the need for centralized institutions. But there’s a catch. DeFi relies heavily on “oracles” to bring real-world data into its blockchain ecosystem. These oracles, often third-party companies like Chainlink or WINkLink, are the linchpin that connects smart contracts with real-world data. But here’s the kicker: these oracles are often centralized entities, which contradicts the very ethos of decentralization that DeFi stands for.

The Trust Paradox

The centralization of oracles poses a significant challenge, especially when it comes to trust. In 2020, a manipulated price of the Dai stablecoin led to a massive $89 million liquidation on the Compound lending platform. Fast forward to 2022, and the DeFi world saw a staggering loss of $403.2 million due to 41 separate oracle manipulation attacks. So, what’s the solution? Stricter regulations? Well, that’s a no-go if you’re a decentralization purist.

Oracles: The Bridge Between Two Worlds

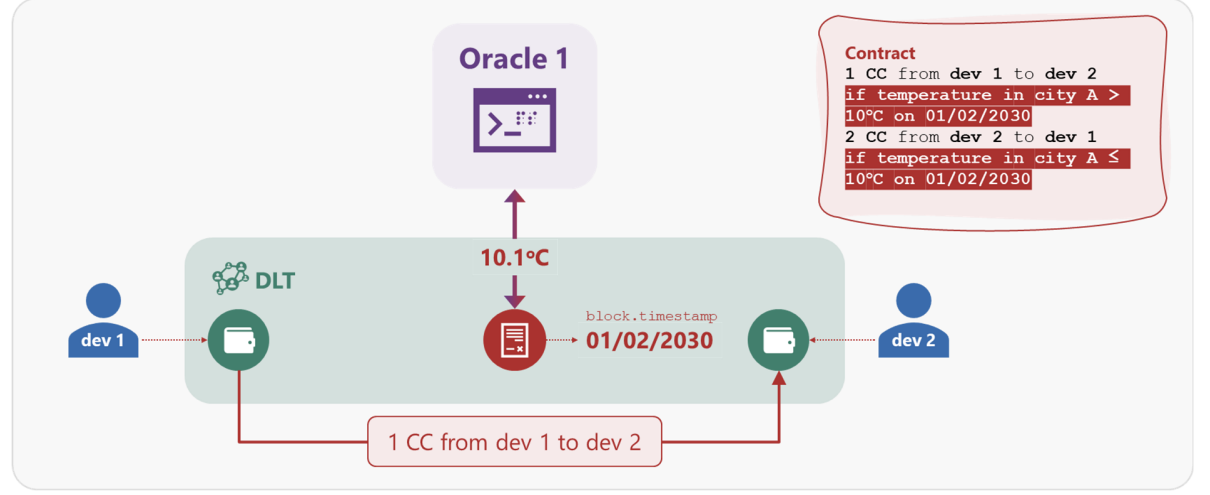

Oracles, in essence, serve as the bridge between the blockchain and the real world. They gather, verify, and feed external data into smart contracts, enabling them to execute based on real-world events. Think of them as the interpreters in a multilingual conference, ensuring that all participants, regardless of their language, understand each other. In the DeFi landscape, oracles can be automated or human-driven. Automated oracles, for instance, might pull data from APIs or IoT devices, while human oracles rely on individuals or groups for information.

The categorization doesn’t end there. Oracles can either be inbound, bringing external data into the DeFi system, or outbound, transmitting data from DeFi platforms to external entities. This dual functionality ensures a two-way flow of information, enhancing the versatility and potential applications of DeFi.

The very nature of oracles, especially their centralization, poses a significant challenge. When a single entity has the power to influence the data being fed into a system, it becomes a potential point of failure or manipulation. This vulnerability was glaringly evident in the numerous oracle manipulations that have rocked the DeFi world. The challenge, therefore, is to design an oracle system that is both trustworthy and resistant to external influences, ensuring that the bridge between the blockchain and the real world remains strong and secure.

The Decentralization Dilemma

The idea of fully decentralized oracles is tantalizing but fraught with challenges. Some argue it’s not just difficult but logically impossible. Why? Because a fully decentralized system lacks a single authoritative source to ensure truthful reporting. Even if we could somehow create a decentralized oracle, the cost in terms of financial resources and operational efficiency would be astronomical.

The Trade-off: Trust vs Efficiency

The crux of the matter lies in the trade-off between trust and efficiency. You can’t have your cake and eat it too. If DeFi wants to maintain its decentralization ethos, it has to compromise on efficiency. On the flip side, introducing some level of centralization to boost efficiency means you’ll have to rely on trusted parties, which is anathema to the crypto world.

The Future: A Crypto-Only Playground?

Given these challenges, the future of DeFi, in its purest form, seems to be limited to crypto-assets. The idea of incorporating real-world assets into DeFi looks increasingly bleak. Trust is not something you can just add to a trustless system; it’s foundational. And in a world that explicitly rejects the notion of trust, the path forward is murky at best.

A Reality Check for DeFi

The “oracle problem” serves as a reality check for the DeFi community. While the allure of a fully decentralized financial system is strong, the practical challenges are significant. The trade-off between trust and efficiency is a hurdle that DeFi has yet to overcome. Until then, the pure form of crypto-based DeFi will likely remain a walled garden, limited to crypto-assets and cut off from the real world.

As we navigate the complex landscape of DeFi, it’s important to remember that not all that glitters is gold. Sometimes, it’s just a shiny object that distracts us from the underlying challenges that need to be addressed.

Source: bis.org